We provide accessible nearshore talent to help you build capacity within your budget.

A Virtual Assistant provides administrative, technical, or creative support services to businesses and entrepreneurs remotely. Utilizing advanced technology and communication tools, they handle tasks such as email management, scheduling, data entry, research, and customer service, enabling clients to focus on more strategic activities. By offering flexible and scalable support tailored to the specific needs of the business, Virtual Assistants play a crucial role in enhancing productivity and efficiency while minimizing operational costs. Their adaptability and diverse skillset make them a valuable asset in various industries.

A remote Virtual Assistant is a professional who provides administrative, organizational, and strategic support to businesses or individuals from a remote location. They handle a range of tasks, including scheduling, data entry, communication management, research, and customer support, allowing businesses to optimize operations and focus on core activities.

Companies can hire remote Virtual Assistants through a remote staffing agency to gain access to skilled professionals across different time zones and industries. This flexible hiring approach ensures cost-effective and efficient business support without the need for in-office staff.

Remote Virtual Assistants are adept at managing administrative responsibilities, coordinating digital workflows, and improving overall business efficiency.

Using platforms like Trello, Asana, or Monday.com helps streamline workflows and ensures clear task delegation and tracking.

Providing a detailed list of responsibilities helps Virtual Assistants understand their role and work efficiently toward business objectives.

Regular virtual meetings via Slack, Zoom, or Microsoft Teams foster collaboration and ensure priorities are aligned.

Since Virtual Assistants may handle sensitive data, businesses should use password management tools, VPNs, and encrypted file-sharing platforms.

Familiarizing Virtual Assistants with company policies, tools, and workflows enhances their ability to integrate seamlessly into business processes.

Allowing Virtual Assistants to take initiative in handling tasks and resolving issues fosters efficiency and reduces managerial oversight.

If managing emails, scheduling, and data entry is consuming too much time, a Virtual Assistant can take over these responsibilities.

Delegating repetitive or time-consuming tasks allows business leaders to focus on high-value activities like strategy and innovation.

Growing businesses require additional organizational support—Virtual Assistants provide crucial assistance in scaling operations.

Virtual Assistants can handle customer inquiries, respond to emails, and provide timely support to improve client satisfaction.

Hiring remotely through a staffing agency allows businesses to access skilled professionals at a lower cost than hiring in-house staff.

Staffing agencies help businesses find pre-vetted Virtual Assistants who match specific skill requirements and experience levels.

Platforms like Upwork, Fiverr, and Freelancer connect businesses with remote Virtual Assistants across various industries.

Seeking recommendations from industry connections can help identify reliable Virtual Assistants with proven expertise.

Argentina is an attractive destination for virtual assistants due to its large pool of English-speaking, college-educated professionals offering high-quality support at competitive rates.

With a strong tech sector, many VAs are skilled in scheduling, email management, research, and remote tools. A 2-hour time difference from New York enables seamless communication with US teams.

Brazil has a skilled workforce and a strong regulatory framework, ensuring reliable virtual assistant services. Its thriving economy and startup scene contribute to a well-educated talent pool. With a 2 to 5-hour time difference from the US, Brazil allows for efficient collaboration.

Colombia offers cost-effective virtual assistant services due to its lower cost of living. Businesses benefit from affordable rates while maintaining a similar time zone.

As a newer player in the talent export market, many professionals lack strong profiles on freelance platforms. Partnering with a staffing firm helps find qualified candidates.

The Philippines is a top choice for virtual assistants, with a large pool of English-proficient professionals. Many international companies operate there, leveraging competitive labor costs ($7,200 to $15,000 USD per year).

A key downside is the 12-hour time difference from the US, which can pose challenges for real-time coordination and urgent tasks.

India has long been a hub for virtual assistant services, with a highly skilled workforce and prestigious business schools. Labor costs range from $5,800 to $9,500 USD per year.

However, the 9-hour time difference from the US makes real-time collaboration challenging, requiring careful scheduling to ensure smooth support.

A remote Virtual Assistant provides essential business support, enabling companies to streamline operations and improve productivity. By hiring through a remote staffing agency, businesses can access top talent worldwide, optimize costs, and ensure seamless administrative assistance.

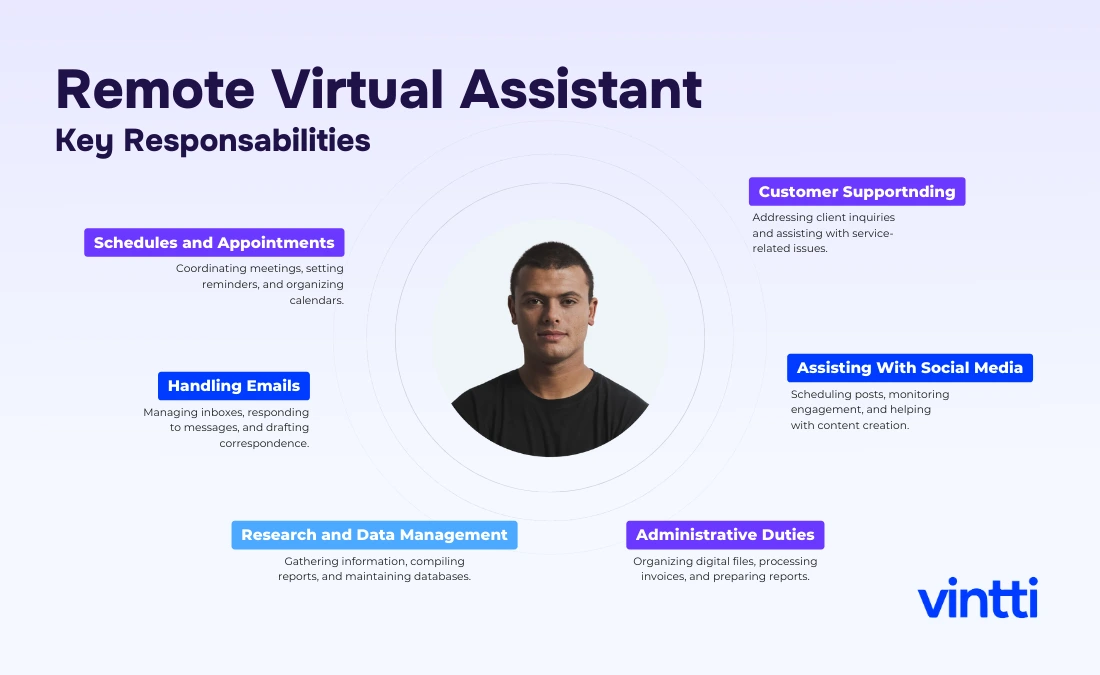

As a Virtual Assistant, one of your core responsibilities involves managing a variety of administrative tasks to ensure smooth business operations. This includes handling email correspondence, scheduling appointments, and organizing calendars to help clients stay on top of their commitments. You will also be responsible for data entry, maintaining databases, and generating reports to provide up-to-date information that supports decision-making processes. Additionally, you may be required to conduct research, gather information, and prepare documents or presentations, thus enabling your clients to access pertinent information quickly and efficiently.

Beyond administrative duties, a Virtual Assistant frequently assists with customer service by responding to inquiries, addressing concerns, and providing support through various communication channels. You may also help with social media management, including content creation, posting, and engagement to boost the client's online presence and brand awareness. Your role extends to technical support, such as troubleshooting basic IT issues or managing software tools that the business utilizes daily. By offering comprehensive support tailored to the evolving needs of the business, you ensure that clients can focus on strategic priorities, enhancing overall productivity and operational efficiency.

Pursuing studies or certifications in business administration, communication, and technology can greatly benefit a Virtual Assistant. Courses in office administration, time management, and customer service are advantageous, as they provide foundational skills necessary for the role. Certifications in project management tools like Asana or Trello, proficiency in software like Microsoft Office or Google Workspace, and familiarity with CRM systems can enhance technical competencies. Additionally, training in social media management, digital marketing, or graphic design can add valuable expertise. Online certifications from recognized platforms such as Coursera, LinkedIn Learning, and Udemy offer flexible learning options tailored to the diverse functions of a Virtual Assistant.

Salaries shown are estimates. Actual savings may be even greater. Please schedule a consultation to receive detailed information tailored to your needs.

Do you want hire fast?

See how we can help you find a perfect match in only 20 days.

Build a remote team that works just for you. Interview candidates for free, and pay only if you hire.

60%

Reduce your staffing expenses significantly while maintaining top-tier talent.

100%

Ensure seamless collaboration with perfectly matched time zone coverage

18 days

Accelerate your recruitment process and fill positions faster than ever before.

.svg.webp)

You can secure high-quality South American talent in just 20 days and for around $9,000 USD per year.

Start Hiring